This is part of our special feature, Confronting Waste.

Biomethane, sometimes also known as green gas, is an efficient, flexible, and eco-friendly alternative to natural gas. Biomethane is the upgraded form of biogas, which is produced from anaerobic digestion of biodegradable waste, such as food waste and crop residues. In simple words, biogas that has been enriched by removing carbon dioxide, hydrogen sulphide and water vapors is known as biomethane. Worldwide, biomethane’s popularity as a carbon-neutral fuel is on the upswing due to its excellent potential to manage organic wastes, provide clean energy and tailor-made urban as well as rural applications.

Sources of Biomethane

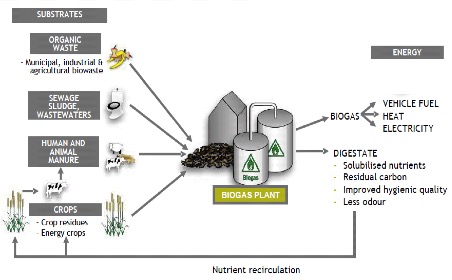

The main sources of biomethane in Europe include landfill gas and anaerobic digestion plants based on energy crops, agricultural residues, food waste, organic industrial waste, and sewage sludge (Figure 1). However, the majority of biomethane in the European Union is produced from crops rather than waste materials. Germany, Austria, and Denmark produce the major share of biomethane from energy crops, agricultural by-products and animal manure, while France, UK, Spain, and Italy are more dependent on landfill gas as a source of biomethane. Sewage sludge is also among the most popular substrates for the production of biomethane in Europe. After agricultural biogas plants, anaerobic digestion plants based on sewage are the largest source of biomethane. A large number of biogas plants are located in agricultural areas with maize being the cheapest raw material for biomethane production. Such areas have plentiful availability of organic wastes like grass silage and green waste, which are cheaper than crops. In many parts of Europe, the practice of co-digestion is followed whereby energy crops are used in combination with animal manure as a substrate.

The biomethane industry in Europe is growing at a rapid rate due to increasing traction in the industrial waste-derived biogas sector and public acceptance of biogas as a clean fuel. According to the 2018 European Biomethane Map, there are more than 500 biomethane production facilities across Europe, out of which 310 new plants were built during 2012 and 2016, an increase of 165 percent.[1] At the end of 2017, there were 540 biomethane production plants in Europe, compared to 187 plants in 2011.[2] Biomethane production has swiftly increased from 752 Gigawatt hours (GWh) in 2011 to 17,264 GWh in 2016.[3] Germany is the market leader with 195 biomethane production plants, followed by the United Kingdom with 92 facilities. In general, there is a trend to establish larger biomethane facilities. As far as biogas production is concerned, Europe produced 16.1 Million Tonnes of Oil Equivalent (Mtoe) in 2016 compared to 10.1 Mtoe of biogas in 2011, an increase of 59 percent.[4]

However, several EU countries are planning to introduce measures to reduce or restrict biogas production from energy crops due to sustainability-related issues. It should be mentioned that energy crops can lead to change in indirect land use, thus putting extra pressure on land availability for cultivation of food crops. As far as waste-derived biomethane is concerned, most of the EU nations are phasing out landfill-based waste management systems, which may lead to rapid decline in landfill gas production thus putting the onus of biomethane production largely on anaerobic digestion of food waste, sewage sludge, industrial waste, and agricultural residues. In this respect, an interesting innovation has been the use of straw as a feedstock for biomethane production. VERBIO AG, a German biofuels company, through the support of the European Union, is operating a biomethane production facility solely based on straw since 2014. This technological breakthrough has made it possible to harness the untapped biomethane potential of tens of millions of tons of lignocellulosic biomass, such as straw, husk wood waste and cane trash that are generated across Europe each year.

Figure 1: Sources of biomethane production in Europe

Biomethane is a well-known and well-proven source of clean energy, and is witnessing increasing demand worldwide, especially in European countries, as it is one of the most cost-effective and eco-friendly replacement for natural gas and diesel. The injected biomethane can be used at any ratio with natural gas as vehicle fuel. One of the main reasons for the rapid growth of the biomethane sector in Europe has been the guaranteed access to the gas grid for all biogas suppliers. The European Directives 55/2003 / EC and 28/2009 / EC give particular importance to the use of gas produced from renewable energy, identifying biomethane as a possible solution to mitigate climate change. These directives require EU members to ensure that biomethane has non-discriminatory access to the transmission network and distribution of natural gas. Germany, Sweden, Finland, Denmark and Holland are the prominent European countries having extensive gas grid infrastructure[5]. Indeed, a major advantage of using natural gas grid for biomethane distribution is that the grid connects the production site of biomethane, which is usually in rural areas, with more densely populated areas. This enables biogas to reach new customers.

Another key advantage of biomethane is that it is less corrosive than biogas, which makes it more flexible in its application than raw biogas. It can be injected directly into the existing natural gas grid leading to energy-efficient and cost-effective transport, besides allowing natural gas grid operators to persuade consumers to make a smooth transition to a renewable source of natural gas. A novel aspect of biomethane is that it can be converted into both liquid and gaseous forms—liquefied biomethane (LBM) or compressed biomethane (CBM) —in order to facilitate its long-term storage and transportation. There are many biomethane projects where the grid may not have sufficient capacity or may be far away from the biomethane production plant, and a good solution will be to convert biomethane directly into a liquid or gaseous fuel for industrial applications. LBM can be transported relatively easily and can be dispensed through LNG vehicles or CNG vehicles. Liquid biomethane is transported in the same manner as LNG, that is, via insulated tanker trucks designed for transportation of cryogenic liquids. Biomethane can be stored as gas in the form of compressed biomethane to save space. The gas is stored in steel cylinders such as those typically used for storage of other commercial gases.

Major Biomethane Utilization Pathways in Europe

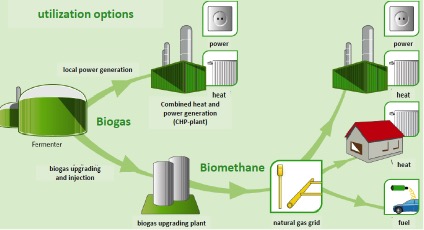

Biomethane has a wide range of applications in the clean energy sector (Figure 2). In Europe, the main pathways for utilization of biomethane include the following:

- Production of heat and/or steam

- Power generation and combined heat and power production (CHP)

- Replacement for natural gas (gas grid injection)

- Replacement for compressed natural gas & diesel – (bio-CNG for use as transport fuel)

- Replacement for liquid natural gas – (bio-LNG for use as transport fuel)

Prior to practically all utilization options, biogas has to be dried (usually through application of a cooling/condensation step). Furthermore, elements such as hydrogen sulphide and other harmful trace elements must be removed (usually trough application of an activated carbon filter) to prevent adverse effects on downstream processing equipment (such as compressors, piping, boilers and CHP systems).

Figure 2: Utilization of biomethane in Europe

Biomethane can be used to generate electricity and heating from within smaller decentralized, or large centrally-located combined heat and power plants. It can be used by heating systems with a highly efficient fuel value, and employed as a regenerative power source in gas-powered vehicles.

Biomethane, as a transportation fuel, is most suitable for vehicles having engines that are based on natural gas (CNG or LNG). Once biogas is cleaned and upgraded to biomethane, it is virtually the same as natural gas. Because biomethane has a lower energy density than NG, due to the high CO2 content, in some circumstances, changes to natural gas-based vehicle’s fuel injection system are required to use the biomethane effectively. For example, Germany has more than 900 CNG filling stations, with a fleet of around 100,000 gas-powered vehicles including cars, buses and trucks. Around 170 CNG filling stations in Germany sell a blend mixture of natural gas and biomethane while about 125 100 percent biomethane from biogas plants.[6]

Barriers to Biomethane Growth

The high costs of upgrading and natural gas grid connection are the major barriers for the development of the biomethane sector. The injection of biomethane is also limited by the location of suitable biomethane production facilities and upgrading sites, which should ideally be located close to the natural gas grid. The European Biomethane Map 2018 provides accurate and specific details about each biomethane plant, including their connection to the gas grid, feed-in capacity, main substrate used, upgrading process and date of start of operation. Several European nations have introduced industry standards for injecting biogas into the natural gas grid. The standards, prescribing the limits for components like sulphur, oxygen, particles and water dew point, are aimed at avoiding contamination of the natural gas grid. Unfortunately these standards differ considerably with each other. Another important issue is the insufficient number of biomethane filling stations and biomethane-powered vehicles in Europe. Many people are still not aware about the benefits of biomethane as a vehicle fuel. Strong political backing coupled with a robust network of biomethane filling stations will go a long way in motivating industries and people to switch to biomethane-powered vehicles and energy systems.

Salman Zafar is an expert on waste-to-energy, biomass energy and waste management

systems. He is the CEO of BioEnergy Consult (India) and Founder of EcoMENA

(Qatar). He writes on clean energy, environmental protection and sustainable

development.

[1] European Biomethane Map 2018. Available at http://www.biomethane-map.eu/ (retrieved on 04/18/2019)

[2] “Statistical Report of the European Biogas Association 2018.” Brussels, Belgium, December 2018.

[3] EBA Statistical Report 2017. European Biogas Association

[4] Biogas Barometer 2012. EurObserv’ER, 2012. Available at https://www.eurobserv-er.org/biogas-barometer-2012/ (retrieved on 04/18/201919).

[5] L. Maggioni and C. Pieroni. 2016. Report on the biomethane injection into national gas grid. ISSAC Project. Available at http://www.isaac-project.it/wp-content/uploads/2017/07/D5.2-Report-on-the-biomethane-injection-into-national-gas-grid.pdf (retrieved on 04/18/2019)

[6] Hoffman, F. 2015. Biomethane Roadmap in Germany. German Biogas Association. Available on http://www.biosurf.eu/wordpress/wp-content/uploads/2015/06/Trebon-VPBPS_2017_14_FVB_Hofmann.pdf (retrieved on 04/12/2019).

Photo: Biogas facility | Shutterstock

Published on May 7, 2019.