This is part of our special feature on Water in Europe and the World.

Water scarcity is ubiquitous, affecting all continents and nations. Water allocation has become a central concern of policy discussions around the world. The World Economic Forum (2015) listed water scarcity as one of the “greatest global [risks] to economies, environments, and people.” In regions such as Latin America, India, and the United States, this phenomenon is especially acute (Barnett et al., 2005). Water markets have emerged as the preferred institution to allocate irrigation water used by farmers in the developed world, particularly in dry regions of the US and Australia (Grafton et al., 2011).

In general, economists expect markets for water to be more efficient than non-market institutions, steering water towards those uses that are most valuable and least costly. However, when frictions are present, markets may not be efficient. Consider, for example, the friction that arises when poor farmers may have insufficient cash to pay for water, due to liquidity or credit constraints. In theory, and without frictions, a market allocates water to the farmer who has the highest valuation. A market failure occurs, however, if some of the farmers who are liquidity constrained have higher valuations than farmers who are not liquidity constrained. In such cases, a water market will fail to allocate a sufficient amount of water to the higher-value, liquidity-constrained farmers and a non-market institution, such as a fixed quota for every farmer, may allocate water more efficiently than a market.

In this article, we compare the efficiency of an auction, the quintessential market, with a non-market institution, a simple system of fixed quotas, as a water allocation mechanism when there are frictions. To do that, we took a close look at a centralized free market for water that was in place for over 700 years, in the Spanish city of Mula. Frictions arose in Mula because poor farmers did not have enough cash during the summer, which is the dry season in Mula, to purchase water in the market (Coman, 1911). In such a setting, a system of quotas may generate greater welfare than an auction, depending on the distribution of wealth (i.e., liquidity constraints) and productivity across farmers. Our paper uncovers these primitives using structural econometric techniques. We found that liquidity constraints were important, and that quotas were more efficient than markets as ways to allocate water in Mula.

Water scarcity and liquidity constraints in Southeastern Spain

The coastal strip of southeast Spain is among the most arid regions in Europe. This aridity arises, in part, due to the foehn effect, and because of its location to the west of the mountain chain Sistema Penibético, which includes the Mulhacén, the highest mountain in the Iberian Peninsula. Weather is an important factor affecting the demand for water, as it determines its seasonality. Rainfall occurs mainly in spring and autumn in this area. Although annual average rainfall is 320 millimeters, the rainfall frequency distribution is uneven. The majority of the years are dryer than the annual average. The number of days when torrential rain occurs is low, but when such rain occurs it is substantial. For example, on October 10, 1943, 681 millimeters of rain water were measured in Mula, more than twice the yearly average during the sample studied in our research.

Water demand peaks during the weeks when the fruit grows most rapidly, which is before the harvest. For the agricultural products cultivated in the region—mainly citrus trees and apricots—demand peaks in spring and summer, between April and August. These conditions made summer the dry or critical season. During the critical season frequent irrigation is advisable, because citrus trees are more sensitive to water deficits, in terms of quality of production.

Given that demand is seasonal, farmers in Mula take into account the joint dynamics of water demand and the price of water, when making purchasing decisions for water. Water today is an imperfect substitute for water tomorrow, because water evaporates from the soil’s moisture of the farmer. In addition, future water prices are difficult to predict. Farmers consider current prices of water and form expectations about future prices of water. A farmer who expects to be liquidity constrained during the critical season—when demand is highest—may decide to buy water several weeks before the critical season, when the price of water is lower.

Farmers sell their output once per year after the harvest. Only then do farmers collect cash revenue from growing their agricultural products. Hence, the weeks when farmers need cash the most to pay for water, the weeks before the harvest, are the weeks furthest away from the previous harvest when they collected the revenue the last time. As a consequence, poor farmers who do not have other sources of revenue may be liquidity constrained. Farmers in Mula are “hand-to-mouth” consumers in that they have only enough money for their basic necessities (González Castaño and Llamas Ruiz, 1991). A farmer who expects to be liquidity constrained in the future would attempt to borrow money. However, poor farmers in Mula did not have access to credit markets.

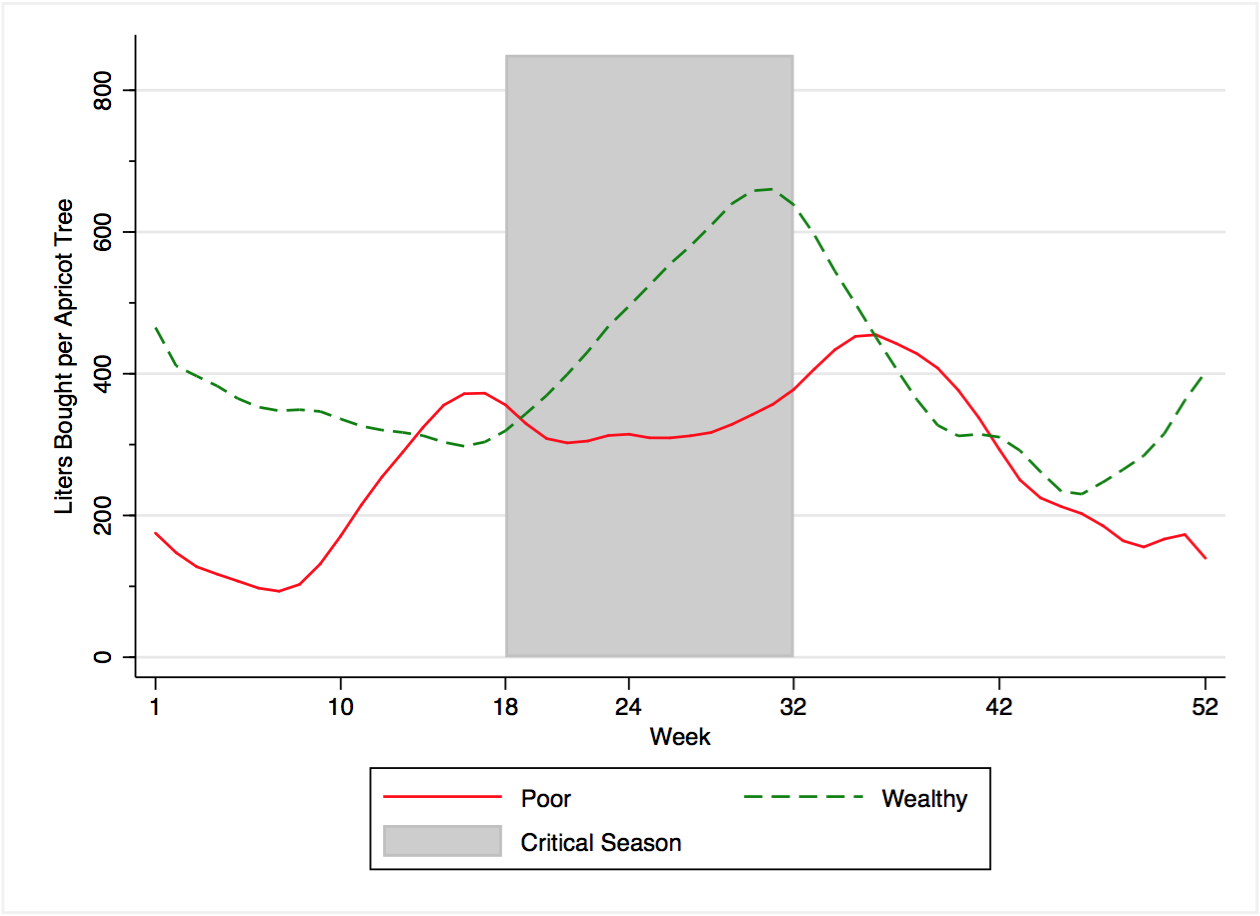

Figure 1. Source: Donna and Espín-Sánchez (2018a). The figure displays the average liters bought per farmer and per tree disaggregated by wealthy and poor farmers. A farmer is considered wealthy if the value of urban real estate of the farmer is above the median among the apricot farmers, and poor otherwise. All the wealthy farmers owned urban real estate, while the poor farmers did not. The shaded area corresponds to the critical season of the apricots trees in Mula. This is the season when more frequent irrigation is advisable.

Figure 1 shows the purchasing patterns of wealthy and poor apricot farmers in Mula under the market. Apricot trees are the most common of the summer crops. The figure displays the average liters per tree that each type of farmer purchased in the auction. All these farmers grew exclusively apricots. The type of apricot tree is identical across farmers. It corresponds to the búlida apricot, which is the typical apricot tree cultivated in the region. The shaded area corresponds to the critical season of these apricots trees. The price of water increases substantially during the critical season because (i) apricots, along with other products cultivated in the region, require more irrigation during this season, increasing the demand for water in the auction; and (ii) weather seasonalities in southern Spain generate less rainfall during these months. Wealthy farmers—who are not liquidity constrained—demand water in line with the water needs of the tree. Wealthy farmers strategically delay their purchases, and purchase water during the critical season, when the apricot trees need water the most. Poor farmers—who may be liquidity constrained—display a peculiar bimodal purchasing pattern for water that is inconsistent with the water need of the tree. The first peak occurs before the critical season, when water prices are low. Poor farmers buy water before the critical season because they anticipate that they may not be able to afford water during the critical season, when prices are high. A fraction of this water will evaporate, but the rest remains as soil’s moisture. The second peak occurs after the critical season, when water prices are again low. After the critical season, a poor farmer’s plot has a low moisture level if they were unable to buy sufficient water during the critical season. Poor farmers buy water after the critical season to prevent their trees from withering.

This purchasing pattern for the poor farmers—high purchases before and after the critical season, and low purchases during the critical season—along with the “standard” purchasing pattern for the wealthy farmers who grew the same type of trees, suggests that the allocation of water under the market is inefficient. Poor farmers receive an inefficiently low amount of water during the critical season, when they are most productive. Wealthy farmers receive large amounts of water. The inefficiency arises due to decreasing marginal returns in the production of apricots: the additional unit of water would have produced more apricots in the plot of the poor farmers.

Institutions in Southeastern Spain: Widespread quotas and limited markets

Farmers in Southeastern Spain obtain irrigation water from the rivers flowing from the mountains in the Sistema Penibético. Water is scarce and valuable in this arid region. For centuries, farmers created efficient institutions to allocate water for irrigation. Each town has an association of irrigators. Water rights are associated to the local river, and are used to allocate the water. On October 2, 2009, the Water Tribunal in Murcia, called Tribunal de los Hombres Buenos (Council of Good Men), was inscribed on the Representative list of the Intangible Cultural Heritage of Humanity by the United Nations (UNESCO, 2009).[1]

Most towns in the area used a non-market institution to allocate water to their farmers. They used a system of fixed quotas, called tandas, whereby each farmer was allocated a fixed amount of time for irrigation, every several weeks. The amount of time was proportional to the size of the farmer’s plot. These rights were non-transferable, non-sellable. This system has been in place at least since the Reconquista in the thirteenth century. The system of quotas provides insurance to the farmers. They are guaranteed to obtain a given amount of water. Such amount is typically enough to prevent the trees from withering during a drought.

There were, however, a few towns in the area that used markets to allocate water. Most notable, the towns of Lorca and Mula used auctions to allocate the water from the river to the farmers. The auction system was active in both cities for more than 700 years, from the thirteenth century until the 1960s, when both cities switched to the system of quotas. Since then, with the system of quotas in Lorca and Mula, farmers who owned a plot of land in the irrigated area were entitled to a fixed amount of water, proportional to the size of their plot.

The origin of this institutional diversity in the area is accidental. In 1242, the Christian kingdom of Castile and the Muslim kingdom of Murcia signed the treaty of Alcaraz. The treaty stated that Murcia would become a protectorate of Castile. It established that Castile would have political control over Murcia, but Muslims living there would keep their assets, their customs, and their lives. The Muslim governors in the cities of Mula and Lorca, however, rejected the agreement. The Christian army then conquered both cities by force, and expropriated all assets from the citizens of both cities, including the water property rights. The conquerors then created a shareholder-owned corporation, a cartel, to hold the water property rights in each city. The original owners of the corporations were the Order of the Temple and the Order of Santiago for Lorca and Mula, respectively. The corporations in each city ran periodic auctions to sell water usage rights, and paid dividends to the owners at the end of the year.[2] All the other towns and cities in the region kept their pre–Reconquista system of quotas.

Markets or quotas? Heterogeneity in productivity and decreasing marginal returns

When liquidity constraints are present, the efficiency of auctions relative to quotas is theoretically ambiguous. There are potentially two sources of inefficiency in the allocation of water. First, the allocation could be inefficient because some farmers receive water at a time when they are relatively unproductive. This inefficiency arises because farmers are heterogeneous in productivity. We call this effect inefficiency due to heterogeneity. Second, the allocation could be inefficient because some farmers receive water when their soil moisture level is relatively high. This inefficiency arises because there are decreasing marginal returns to water. That is, subsequent units of water result in smaller increases in apricots’ output. We call this effect inefficiency due to decreasing marginal returns.

Quotas allocate water units uniformly, so they always create inefficiency due to heterogeneity, but not inefficiency due to decreasing marginal returns. Markets would correct both inefficiencies if there were no liquidity constraints, but they would create both inefficiencies when liquidity constraints are present. If farmers are heterogeneous and the production function is linear in the number of units of water—that is, no decreasing marginal returns—markets are always more efficient than quotas. Quotas are more efficient than markets when there is large heterogeneity in wealth, and low heterogeneity in productivity. Markets are more efficient in the opposite case. In the general case, where there is heterogeneity in both wealth and productivity, the efficiency of markets relative to quotas is ambiguous.

A cautionary tale from Mula

We found that the institutional change in Mula, from auctions to quotas, was welfare improving for the apricot farmers due to two main effects. First, large heterogeneities in wealth created liquidity constraints in Mula. Due to the dynamics caused by the water accumulated in the farmers’ land (the moisture in their plots), liquidity constraints created large inefficiencies due to decreasing marginal returns. In other words, the market predominantly allocated water to wealthy farmers with high moisture levels, instead of allocating it to poor farmers with low moisture levels. Second, the famers considered in Mula were relatively homogeneous. Under the market farmers do choose when to irrigate. They trade with each other to irrigate during their preferred weeks of the year. However, wealthy and poor farmers in Mula were similarly productive. They all grew the same type of apricots’ trees. Thus, the inefficiency due to productivity under the system of quotas was relatively low. As a consequence of these effects, the system of quotas outperformed the auction in terms of welfare. This analysis focuses only on efficiency. Note, however, that the system of quotas increased both fairness and efficiency in Mula, relative to the market system. This feature helps explain the extraordinary stability of the system of quotas and the irrigation communities in the area, which survived for over seven centuries until today.

In sum, our results provide empirical evidence of a source of inefficiency in water markets. However, one should not conclude that all water markets are inefficient. Instead, our results indicate that policy makers should be cautious when using markets to allocate water in settings where these two features—large heterogeneities in wealth and low heterogeneities in productivity—are present. This would typically be the case for water allocation among farmers within the same basin, but not among farmers’ communities across basins. The results are especially relevant for developing countries, where liquidity constraints may be important, and water is demanded for agricultural purposes, where productivity differences are typically low.

Javier D. Donna is the Howard P. Marvel Scholar Assistant Professor of Economics in the department of economics at The Ohio State University, where he teaches since 2012. His research focuses on investigating the efficiency of market and non-market institutions. He has done research in the areas of water, transportation, labor, and online trading platforms.

José-Antonio Espín-Sánchez is Assistant Professor of Economics in the department of Economics at Yale University, where he teaches since 2014. He is an economic historian with interests in economic theory and industrial organization. His research focuses con water allocation mechanisms and the economic history of Mediterranean Spain.

References:

Barnett, T. P., Adam, J. C. and Lettenmaier, D. P., 2005, “Potential impacts of a warming climate on water availability in snow-dominated regions,” Nature, Vol. 438, 303-09.

Coman, K., 1911, “Some Unsettled Problems of Irrigation,” American Economic Review, Vol. 1, No. 1, 1-19.

Donna, J. D. and Espín-Sánchez, J.-A., 2018a, “The Illiquidity of Water Markets: Efficient Institutions for Water Allocation in Southeastern Spain,” working paper.

Donna, J. D. and Espín-Sánchez, J.-A., 2018b, “Complements and Substitutes in Sequential Auctions: The Case of Water Auctions,” RAND Journal of Economics, Vol. 49, No. 1, pp. 87–127.

González Castaño, J., and Llamas Ruiz, P., 1991, “El agua en la Ciudad de Mula,” S. XVI-XX., Comunidad de Regantes Pantano de la Cierva, Mula.

Grafton, R. Q., Libecap, G., McGlennon, S., Landry, C. and O’Brien, B., 2011, “An Integrated Assessment of Water Markets: A Cross-Country Comparison”, Review of Environmental Economics and Policy, Vol. 5, No 2, 219-239.

UNESCO, 2009. “Convention For The Safeguarding Of The Intangible Cultural Heritage,” Decision for inscription on the Representative List in 2009, ITH/09/4.COM/CONF.209/13 Rev.2. Available online at http://www.unesco.org/culture/ich/doc/src/ITH-09-4.COM-CONF.209-13-Rev.2-EN.pdf#Decision1370.

World Economic Forum. “Water crises are a top global risk.” 16 January 2015. Accessed on October 9, 2018. https://www.weforum.org/agenda/2015/01/why-world-water-crises-are-a-top-global-risk/

[1] A summary and video can be found in the UNESCO webpage, here.

[2] We study the details of the action system in Mula in Donna and Espín-Sánchez (2018b).

Photo: Irrigation ditch | Shutterstock

Published on December 11, 2018.