This is part of our special feature on Nationalism, Nativism, and the Revolt Against Globalization.

Shortly after he was sworn in as the 45th president, Donald Trump took the United States out of the Transpacific Partnership (TPP).[1] The TPP was President Obama’s signature free-trade agreement with 11 other Pacific Rim countries, and part of the “pivot to Asia”—a strategy to solidify the U.S. economic footprint in Asia. Under the banner of “Make America Great Again,” presidential candidate Trump took every opportunity to call for more protectionism and to blame “bad trade deals” for the predicament of the United States. The current U.S. account deficit and its trade imbalance with China especially fueled Trump’s ire. Additionally, Trump’s call to build a wall along the southern border was a focal point of the campaign, and is still on the administration’s agenda. A skeptic of multilateral organizations such as the United Nations (UN) or the North Atlantic Treaty Organization (NATO), Donald Trump has called the current World Trade Organization (WTO) a disaster and has sought to postpone the nomination of judges on its vital appeals panels. The current U.S. president has made clear that he favors bilateral as opposed to multilateral trade agreements, believing that the former allow the United States to more fully exploit its leverage as a large country. Many consider the mentioned examples of Trump’s antitrade and immigration rhetoric as evidence of the current backlash against globalization and evidence of the ever-louder call for more national sovereignty. They would argue that these examples are not unrelated to, for instance, the decision of Great Britain to leave the European Union (Brexit), or the right-wing calls in France to leave the European Monetary System in the run-up to the presidential elections.[2]

In this article, I spell out what distinguishes the current round of criticism of globalization from past instances. I also discuss potential answers to the challenges that we face; however, the optimal answer is not to reduce globalization and to revert to simplistic nationalism. The root cause of the problem is not even globalization per se, but rather U.S. society’s unwillingness or inability to share the gains from globalization, or more broadly, to provide its citizens with equal access to its services, to high-quality education, and to a safety net that protects against the uncertainty that has many sources beyond globalization.

Globalization in Perspective

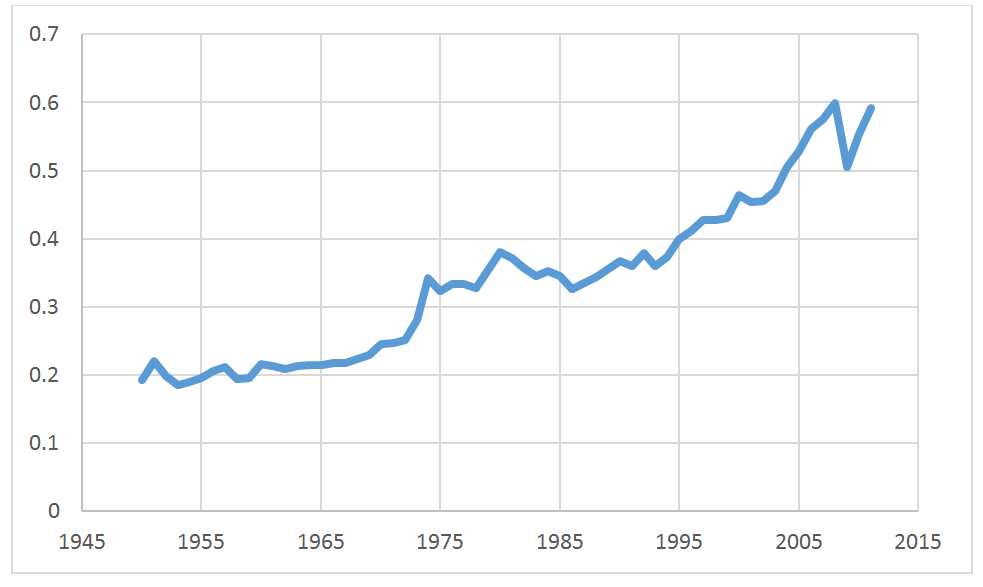

Globalization is not a new phenomenon. There have been multiple waves of globalization that differ in both timing and the sets of countries and industries involved.[3] The period before World War I, for example, was a time of almost unfettered freedom for the international exchange of goods, as well as for international capital flows. It was also a period of unprecedented international migration. World War I and the trade wars and beggar-thy-neighbor policies following the depression of the late 1920s then brought globalization to a halt. In turn, the liberal world order of the post-World War II years, built around the International Monetary Fund (IMF), the World Bank (WB) and the Global Arrangement on Tariffs and Trade (GATT) with its many multilateral trade-liberalization rounds, sought to undo the protectionism of the interbellum years. The liberal order was supported by the security framework of NATO, the U.N., and the outsize influence of the United States. Since then, international capital movements have dwarfed past ones in terms of both volume and speed, even though the migration flows have never reached the intensity of the period before World War I. However, the single measure that best exemplifies the steady globalization of the world economy since 1945 is its growing openness, see Exhibit 1. The ratio of overall trade (exports plus imports) to world GDP shows a fairly steady increase in the part of world GDP that is traded internationally. Even so, and in spite of the clear thrust toward open markets globally, it is not the case that the support for a world with more open trade has always been equally strong.

In the wake of the economic crisis of the mid- and late 1970s, for example, there were increased calls for protectionism. In spite of previous rounds of trade negotiations that successfully reduced tariffs, there was a surge in nontariff barriers such as quotas and voluntary export restriction to restrict international transactions. Worth mentioning here also are the 1999 Seattle riots that accompanied attempts to launch new multilateral trade negotiations under the WTO. The WTO had been founded a few years earlier and was meant to replace and extend the GATT. It was the WTO’s ambition to promote trade in agriculture and services (not just manufacturing that had dominated liberalization till then), to write the rules for foreign direct investment and intellectual property rights, and to further design a set of internationally agreed rules and procedures centered around nondiscrimination and reciprocity to govern international trade. At the time of the Seattle riots, there were calls for better safeguards for the environment and for labor rights in future international trade agreements. Recessions and economic slowdowns are typically fertile ground for protectionist sentiments, since whatever adjustment trade liberalization requires, it is easier to attain those in a growing economy. The Great Recession of 2007, brought about by a financial crisis, has fueled the latest anti-globalization sentiments that were so prominently on display in the recent presidential campaign. This last round of criticism of globalization stands apart in how much it casts its criticism in terms of growing inequality.

The Current Criticism against Globalization

What has been striking since the 1990s (and before the financial crisis of 2007 hit), is the intensification of globalization. Indeed, the trade to GDP ratio has accelerated since then, which is a phenomenon observed also for many individual advanced economies such as the United States. Moreover, this period is characterized by persistent and growing in wage inequality between skilled and unskilled labor in many countries and especially in the United States, which relates to an important degree to the higher and increasing return rate to (college) education (see Autor 2014).[4] There is broad consensus among economists that many factors beyond globalization help explain both phenomena. Automation and technological progress, for example, bring with them a higher demand for skilled labor and certainly have a hand in generating increased wage inequality for manufacturing occupations. There is also the decrease in unionization, reduction in the highest marginal taxation, or the growing service economy (70 percent of GDP) that has a less important manufacturing sector as its flip side.

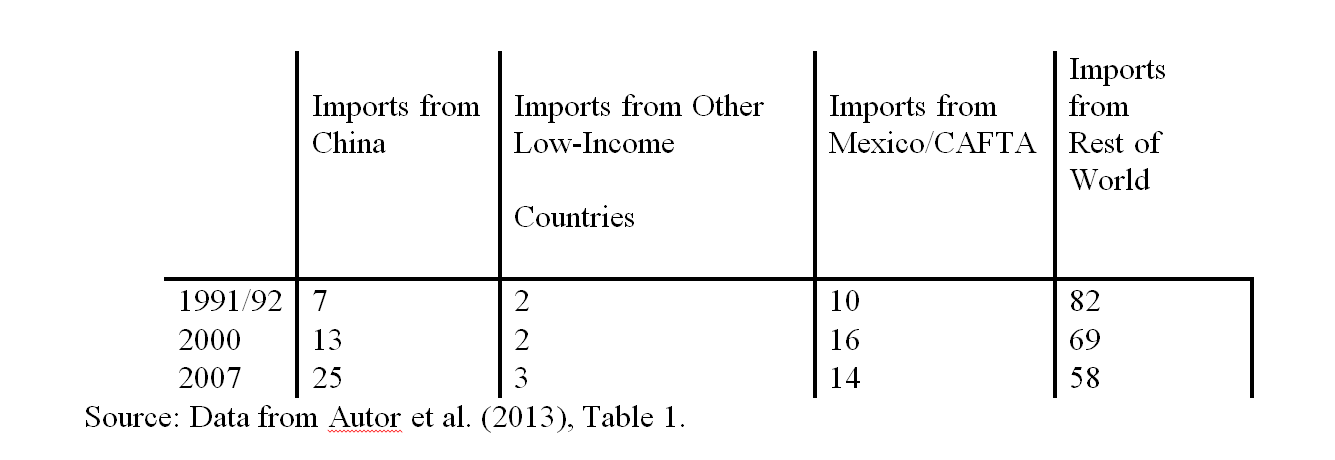

In recent years, researchers have directly linked the intensification of globalization since the 1990s to increased wage inequality especially, but not only, in the United States. Such a link between inequality and international trade is quite intuitive and in line with what economists expect.[5] The intensification of globalization is directly linked to the exploding imports from China and other developing countries since the 1990s. Take the United States, see Exhibit 2, whose imports from low-wage countries has skyrocketed from a modest share of 9 percent of total imports in 1991 to 15 percent in 2000, and as much as 28 percent in 2007. For reference, China formally became part of the WTO in 2001. It is this growing trade with low-wage countries that is especially low-skill intensive and that poses a challenge for blue-collar America. Indeed, such imports directly compete with domestic lower-skilled workers. Researchers have documented a direct link between the extent to which regions (to be precise, 700+ metropolitan commuter zones in the United States) have been exposed to trade with China and prolonged periods of unemployment, or lower labor force participation. This latter finding, in addition to measured downward pressure on low-skill wages, is quite significant. It has brought home that the U.S. labor market is far less flexible in adjusting to shocks than is often anticipated, and that globalization is one of the factors negatively affecting blue-collar workers. Note that additional research has also linked the exposure of U.S. regions to trade with China to the unparalleled increased midlife mortality rate that reverses decades of progress in mortality reduction for white non-Hispanics aged from 45 to 54 since 1999—all other ethnicities and older categories in the United States continued to see mortality declines. This research builds on findings by 2015 Nobel Prize Laureate Angus Deaton and his coauthor Ann Case who link the higher mortality to suicide, drug poisoning, and worsening health conditions as well as on the decline of manufacturing in which whites are overrepresented.[6] Additional research links the trade exposure with political polarization across the United States.[7]

What are the Gains from Globalization?

In light of the bad press that globalization has received, and in light of the established link between increased trade with low-wage countries and wage inequality, prolonged unemployment, and lower labor force participation, one would almost forget that globalization has its benefits. Trade is politically so toxic, that few have come to its defense. In the past presidential campaign in the United States, virtually none of the candidates ever bothered to argue for the benefits of globalization.

Most economists are in favor of globalization especially where it involves increasing trade. The reason for their position is relatively straightforward. International trade allows for a more efficient allocation of production on a global scale. When countries trade, they are no longer forced to produce all the goods that domestic consumers want themselves. With international trade, countries produce the goods they are relatively good at producing (i.e., for which they have a comparative advantage) and export those. They import the goods they do not produce that well. For example, one expects advanced economies to export high-skill or human-capital-intensive products and services, and less advanced economies such as China more labor-intensive products. This more efficient global production increases total world output (i.e., a bigger pie), which is why, all countries could be better off in a world of free trade. This, in a nutshell, is the most common argument in favor of free trade. There are, however, many other supportive arguments, which I will not elaborate on (i.e., more international competition undercuts local monopolies, international markets provide access to more varieties of goods, and so forth). Note also that most economists favor a multilateral trading regime supported by multilateral organizations such as the WTO. Such a system, while imperfect and in need for more transparency and democratic legitimacy, is perhaps the best way of bringing smaller countries into the world trading system, preventing abuse by larger countries, and insuring against mutually destructive trade wars like the ones of the interwar years (Bagwell and Staiger, 2002)

It is a central insight of basic economics that the net overall gain that freer trade generates is not distributed equally within a country. There are always winners and losers after a liberalization. In the case of heightened trade and competition from low-wage countries, for example, an advanced country’s unskilled labor tends to lose, whereas its high-skilled labor tends to gain. Hence, a society’s willingness to share the net gains from trade among all its citizens is essential in order to secure broad-based support for a liberal trading regime. Put differently, with ample evidence that the low-skilled manufacturing workers have been negatively affected by more open markets (which is in line with what one would expect), it is absurd to expect support for free trade among that segment of the population, if there is no explicit commitment to sharing the gains from trade between winners and losers. The documented adverse effect of trade, and the explicit calls for domestic protectionism suggest that the distribution of the gains from trade are either not happening or not effective—see also next section.

It’s Not Just Trade

As noted, recessions are more likely to be anti- rather than pro-globalization. The current wave of populist, antitrade sentiment follows on the heels of the severest recession since World War II. What is remarkable, from the U.S. point of view, is that the Great Recession of 2007 primarily had a domestic (not international) cause. Moreover, the crisis and its aftermath have been steeped in questions of societal inequality. The Great Recession was in essence a domestic credit crunch. Banks and financial institutions stopped lending as they became overly exposed to risky assets that were directly linked to the imploding housing-market bubble. While there is plenty of blame to go around, banks and financial institutions (whose executives and (some of its) employees are among the highest earners in the country) had a non-negligible hand in causing the economic havoc. Adding insult to injury, banks got bailed out, few executives were charged, many had to foreclose on their homes, and quantitative easing with historically low interest rates probably benefited the financially savvy investor more than average saver who saw the return on his savings decrease. And this brings me to the broader point of this article, which also comes alive when reading Amy Goldstein’s Janesville: An American Story, the prize-winning book that through the lives of the (white) Janesville community relates the impact of GM shutting down its oldest plant in the wake of the Great Recession.

The United States is a country with growing inequality and low upward mobility. It is a country where it increasingly matters what household you grow up in, what part of town you live in, and what schools you attend. It is not the case that education is the great equalizer.[8] What job you hold matters for the type of insurance you have, and the type of compensation you obtain in case you lose employment, or your ability and willingness to move. Yes, increased competition from low-wage countries has had negative impacts for blue-collar America, but so have many other events like the Great Recession that are not directly linked to globalization. The root cause of the challenges that we face is not globalization per se. Rather, it is society’s unwillingness or inability to (design policies that) share the gains from globalization, and more broadly, to provide its citizens equal access to its services, to high-quality education (starting with pre-school education), and to a safety net that protects against uncertainty that has many other sources beyond globalization. While cross-country comparisons are difficult, rarely has one heard in Europe the likes of the current U.S. call for protectionism, even though European economies tend to be more open economies. To be explicit, even the UK’s ambition after Brexit is to achieve (more) open markets. A plausible explanation is that this different attitude w.r.t. trade-related globalization may well be, as Rodrik (2017) argues, the size of its (more generous) welfare state.

And there is Also Migration…

It is hard to ignore that the current anti-globalization sentiment in the United States is very unfriendly to immigrants. There are multiple pieces to the puzzle. In spite of the benefits that migration brings (some jobs performed that locals do not want, larger demand for local goods, more affordable hotel services, and so on), it is likely to put downward pressure on wages for at least some low-skill income groups. The concern is not so much high-skill immigrants. College-educated graduates may actually embrace the multicultural diversity of immigration, or have the skill to move, if they do not. More (international) diversity associated with migration may be more of a threat than an opportunity for lower-skilled workers, who tend to be less mobile and in direct competition with low-skill immigrants. At this point, there is no unfettered, free immigration in the United States, or in many advanced economies. With the vast number of illegal immigrants currently in the United States, it is not a hard point to make, however, that the current system of immigration is not functioning well. What is needed is an immigration system that protects everyone under the law and that is the political outcome of a societal debate, and one that has popular support. In its absence, xenophobic overtones are likely to persist.

Exhibit 1: World Trade (exports + imports) as Share of World GDP.

Source: Penn World Table 8.1.

Exhibit 2: Origins of U.S. Imports (1991/92–2007) in Percent of Total Imports

Source: Data from Autor et al. (2013), Table 1.

Peter Debaere is a Professor of Business Administration at the Darden Graduate Business School at the University of Virginia where teaches MBAs and Executives. Debaere is an international economist with a PhD from the University of Michigan. His research focuses on international trade, multinationals, and trade policy. In recent years, he has also studied the economics of water, especially in a global context. He leads the Global Water Initiative that bring together scholars from across UVA. Debaere’s papers have been published in top general interest and field journals such as Journal of Political Economy, American Economic Journal: Applied, the Journal of International Economics, and the Journal of Development Economics. He is also on the advisory board of the Center for German Studies.

References:

Autor, 2014, Skill, education, and the rise of earnings inequality among the “other 99 percent,” Science, 344, p. 843-851.

Autor, D., Dorn, D., and G. Hanson, 2013, The China Syndrome: Local Labor Market Effects of Import Competition in the United States, American Economic Review, 103 96), p. 2121-2168.

Autor, D., D. Dorn, G. Hanson and J. Song, 2014, Trade Adjustment: Worker-Level Evidence, Quarterly Journal of Economics, p. 1799-1860.

Autor, D., D. Dorn, G. Hanson, and K. Majlesi, 2017, Importing Political Polarization? The Electoral Consequences of Rising Trade Exposure, NBER Working Paper Nr. 22637.

Bagwell, K. and R. Staiger, 2002, The Economics of the World Trading System, MIT Press, Cambridge.

Baldwin, R., 2016, The Great Convergence, Information Technology and the New Globalization, The Belknap Press of Harvard University Press.

Case, A. and A. Deaton, 2015, Rising morbidity and mortality in midlife among white non-Hispanic Americans in the 21st century, Proceedings of the National Academy of Sciences, December 8.

Debaere, Peter, 2003, Relative Factor Abundance and Trade, Journal of Political Economy, p. 589-610.

Debaere, Peter, 2018a, Trump says the WTO is a Disaster, Darden Business Publishing, case GEM 152.

Debaere, Peter, 2018b, Labor’s Plight, Darden Business Publishing, case GEM, forthcoming.

Goldstein, A., 2017, Janesville: An American Story, Simon & Schuster, New York

Irwin, D., 2015, Free Trade under Fire, Princeton University Press.

Romalis, J., 2004, Factor Proportions and the Structure of Commodity Trade, American Economic Review, pp.67-97

Pierce, J. and P. Schott, 2017, Trade Liberalization and Mortality: Evidence from U.S. Counties, NBER Working Paper WP22849.

Rodrik, D., 2017, Populism and the Economics of Globalization, Working Paper.

[1] Most of the trade references are discussed more extensively in Debaere (2018a), see also Debaere (2018b).

[2] See, https://www.forbes.com/sites/haroldsirkin/2016/12/15/how-to-cure-the-globalization-backlash/#536b18a65d6c ; https://www.economist.com/blogs/buttonwood/2016/07/economics-and-politics-0; https://www.theguardian.com/world/2017/jul/14/globalisation-the-rise-and-fall-of-an-idea-that-swept-the-world.

[3] For a good discussion of the phases of globalization, see Baldwin (2017), for a discussion of esp. the U.S., long-run perspective see Irwin (2015)

[4] Across the whole spectrum of low-skill service and manufacturing occupations, one finds a polarization in how wages evolve. Both low-skill service occupations and higher-skill service and manufacturing occupations see wage growth, yet low-skill manufacturing occupations see their wages drop, see Autor et al (2014).

[5] Evidence that differences in labor and (human) capital availability between rich and poor countries matter for understanding their trade, see Romalis (2004) and Debaere (2003)

[6] Case, A. and A. Deaton (2015), Pierce and Schott (2017).

[7] Autor et al. (2017)

[8] See Autor (2014)

Photo: Gage Skidmore | Flickr

Published on February 1, 2018.