This is part of our special feature on The Crisis of European Integration.

“Managed Futures” depicts illusion, greed, and over-consumption as the core principles that led to the 2008 economic crisis. Renowned British artist, Mat Collishaw addresses a range of issues from the illusion that wealth provides happiness and saturation to insights into the peculiar greed and shortsightedness of human nature as part of an “excessive binge culture.” Nelson Saiers, a former investment guru, who has been referred to as the “Warhol of Wall Street,” reveals with his work the deep relationships and interconnectedness between diverse sets of financial products and even economies. Both artists address extreme events and wrestle with the impact that financial illusions have on the human psyche, a vicious cycle which Blain|Southern rightfully named with THIS IS NOT AN EXIT.

–Nicole Shea for EuropeNow

Mat Collishaw

For his second solo exhibition at Blain|Southern, THIS IS NOT AN EXIT, the British artist Mat Collishaw returns to the medium of oil painting. However, as is usual with his practice, nothing is literal; the primary source material – magnified images drawn from the pages of glossy magazines – is a simple metaphor, one part of a prism conceived to examine moral questions provoked by the excessive binge culture that preceded the global financial crisis.

When seen from a distance, these large-scale works appear to be abstract paintings constructed on a classic modernist grid; closer inspection reveals them to be scraps of advertisements for luxury goods culled from ‘lifestyle’ magazines like Tatler and Vogue. But this is only partially the case; they are in fact facsimiles of the precisely folded, origami-like ‘wraps’ used by drug dealers to package cocaine, complete with powdery traces of the narcotic.

Our susceptibility to sensational imagery has long been central to Collishaw’s work, and these sumptuous paintings continue this tradition. For all their apparent swagger, they are in reality depictions of nothingness, revealing the symbiotic space that exists between illusion and reality, absence and presence. Symbolically, the excesses of capitalism and the over stimulation of consumerism that precipitated a culture of greed and, subsequently, the economic crisis of 2008, are referenced – a mode of living which has proven to be a constructed fantasy, a glittering mirage. More prosaically, they are emblematic of the craven, insatiable aspect of human nature that will pursue something to its very end whatever the consequences, and yet inevitably remain unfulfilled. It is this unending vicious cycle to which Collishaw alludes in the exhibition’s title; there is no escape – this is not an exit – the words used at the close of Bret Easton Ellis’ novel American Psycho, which satirised the excesses of Wall Street in the 1980s.

(This is an excerpt from Blain Southern’s Press Release, 2013)

Blain|Southern Video Coverage: https://www.youtube.com/watch?v=kTVGkvY0U2s

Dusk Till Dawn, 210 x 210 cm, 2012

Elysium, 230 cm x 230 cm, 2012

Polomino, 230 cm x 230 cm, 2012

Urban Legends, 225 x 225, 2012

Sinners, 225 x 225cm, 2012

Idol Hour, 225 cm x 225 cm, 2013

Mat Collishaw (b. 1966) is a key figure in the important generation of British artists who emerged from Goldsmith’s College in the late 1980s. He participated in Freeze (1988) and since his first solo exhibition in 1990 has exhibited widely internationally. Recent solo exhibitions include Bass Museum of Art, Florida (2013); Pino Pascali Museum Foundation, Bari (2013); Mat Collishaw: Afterimage, Arter, Istanbul (2013) and Magic Lantern at the Victoria and Albert Museum, London (2010). Recent group exhibitions include GLASSTRESS: White Light/White Heat: Contemporary Artists & Glass, collateral Event of 55th Venice Biennale, Venice (2013); About Caravaggio (curated by Anna Imponente), Museo Tuscolano – Scuderie Aldobrandini, Frascati Rome (2012); 720°, as part of Ron Arad’s Curtain Call Project, The Israel Museum, Jerusalem (2012); Made in Britain, Contemporary Art from the British Council Collection, Benaki Museum, Athens (2012); Out of Focus: Photography, Saatchi Gallery, London; Otherwordly – Optical Delusions and Small Realities, Museum of Arts and Design, New York (2012); and the 12th International Istanbul Biennial, Istanbul in 2011. Collishaw’s work is in several public collections including Centre Georges Pompidou, Paris; Museum of Contemporary Art, San Diego; Museum of Old and New Art, New South Wales and Tate, London.

Nelson Saiers

Before becoming an artist, Saiers worked in finance where he ran among others a proprietary trading business at Deutsche Bank and later a global derivative hedge fund called Saiers Capital. These jobs overlapped with the 2008 Crash and the European Sovereign Debt Crisis. “Until he left the firm in 2014, the $600 million hedge fund was known as one of the best practitioners in the niche of volatility investing — his firm’s algorithms were designed to identify when volatility in the price of an asset signaled future profit opportunities” according to CNBC.

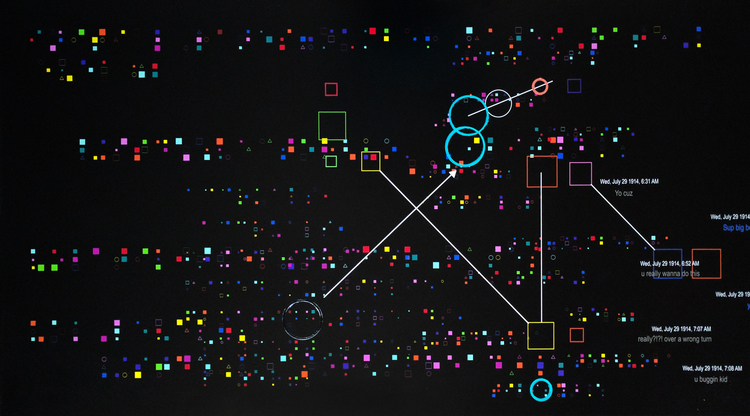

Saiers’ works are created from snippets of code from computer algorithms that were once key to his hedge fund trading strategy when scouring financial products across the globe and comparing them to determine their individual value/risk. The circles and squares represent the problem of predicting how financial markets will behave.

Featured here are events surrounding the advent of WWI, the ramifications of the treaty of Versailles that resulted in the 1923 German hyperinflation, and the impact of mismanaging a portfolio of derivatives. One of the significant causes of the 2008 crisis was collective short-sightedness and blindness to modern finance. This endemic blindness, which was the motivation behind Saier’s choice of using braille, plagued almost everybody: investors, ratings agencies, and even government regulators. Accordingly, when assessing new bank regulations, future bailouts, international trade agreements, Brexit and even the strengths and weakness of globalization, not weekly polls but long-terms sets of data should be key factors.

Midas, Aluminium Panel, Ink Acrylic Paint, 2015

Yo Cuz, Aluminium Panel, Ink Acrylic Paint, 2015

Icarus Strangled, aluminium panel, ink, Acrylic Paint, UV, 2015

Nelson Saiers’ time working in the financial industry coincided with both the 2008 Crash and European Sovereign Debt Crisis that followed. Related to the drama unfolding in the financial markets, his career also overlapped unprecedented government action from bank bailouts to regulatory changes, including a law which was related to his previous job as a proprietary trader, the Volker Rule. His impression of these occurrences combined with the fear, greed shortsightedness and helplessness that resulted from the Crash played a significant impact on his series of artwork that focus on Wall St. Saiers earned a PhD in mathematics at the age of 23 and, accordingly, his art is informed by contributions to mathematics from the time of Euclid through the present. Recent solo exhibitions include HG Contemporary Gallery, NY, Harvard University, and Alcatraz Island.

Nicole Shea ran CenterArts Gallery in Newburgh from 2009-2012 and later incorporated her arts experience into the leadership training at West Point. In 2015, she founded a large-scale sculpture walk outside the gates of West Point, which she has been curating together with the founding members of Collaborative Concepts in a community effort to revitalize the area via the arts. She is also Executive Editor of EuropeNow and Director of the Council for European Studies.

Published on November 2, 2017.